What's a Good Score?

What's a Good Score?

What’s a Good Credit Score?

Maintaining good credit has its benefits, especially when you are looking to secure a mortgage. When you apply, it’s your middle score that is used—not your high score or low score. Little dips and raises in your score from month to month are normal.

The reality is that there is no universally "good” FICO score short of the sacred 850. There’s also no universally "bad” FICO score until you fall into the sub 500 range. Most of us live somewhere within that range, and a good or bad score is going to depend on what the company evaluating your credit wants to see. A good score is whatever it takes to qualify for what you’re applying for, with the best terms possible.

Typically lending is loosening up, but it’s not where it was in 2005. In today’s market, a 750 plus FICO score can for the most part get you what you want. When you fall below 750 is when you may start to roll the dice with whatever you are applying for.

Who Sees Your Score?

In addition to loan and credit applications, your credit is evaluated in several normal activities you may wish to participate in. These include applying for a job, or trying to purchase auto, life or homeowner’s insurance. It’s also evaluated when you turn on new utilities, rent an apartment, or start cell phone service.

Keep in mind:

- Your payment history is 50 percent of your score. Simply paying your mortgage on time can help increase your score.

- Avoid new purchases when you’re trying to raise your score. Big-ticket items such as a new car, new carpet for a home, or an extravagant vacation can harm your credit while you’re waiting for a home loan application.

- Improved credit can result in reduced rates for auto insurance policies. If you have no new traffic violations, or you are looking for homeowner’s insurance, it may be time to have your policy re-evaluated.

- If your home loan application goes beyond 90 days or you are unable to find a home in that time, the lender may have to pull your credit again, and you may take another credit inquiry hit to your score.

- Leaving open old and unused accounts can be a good thing. You’re only using a fraction of your credit.

What We Offer

Customer Support

We have an award winning support staff.

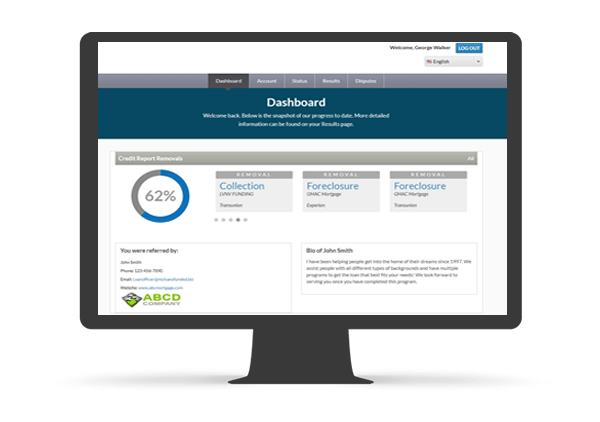

24/7 Tracking

Your own online portal to track results.

Text/Email Updates

We communicate with you every step of the way.

Proven Strategy

Let our expertise guide you to better results.

Unmatched Results

We have one of the highest fix/delete ratios in the industry.

Aggressive

We do not limit our disputes.

Save Time and Money

Let us do the heavy lifting for you.

Easy Setup Process

Call us today! 630-208-0800

and more...

Why We Are Different

Most companies just send out template letter after template letter hoping for different results. We understand that each client is unique in their situation. We have a strategic approach aimed toward each client’s individual needs. We know how to get the best results for you, and we spell it out from the beginning.

We also pride ourselves on communication with our clients. Through text message and email alerts, we keep you in the loop throughout the process. We’re always just a phone call away if you have questions or need advice.